schedule c tax form llc

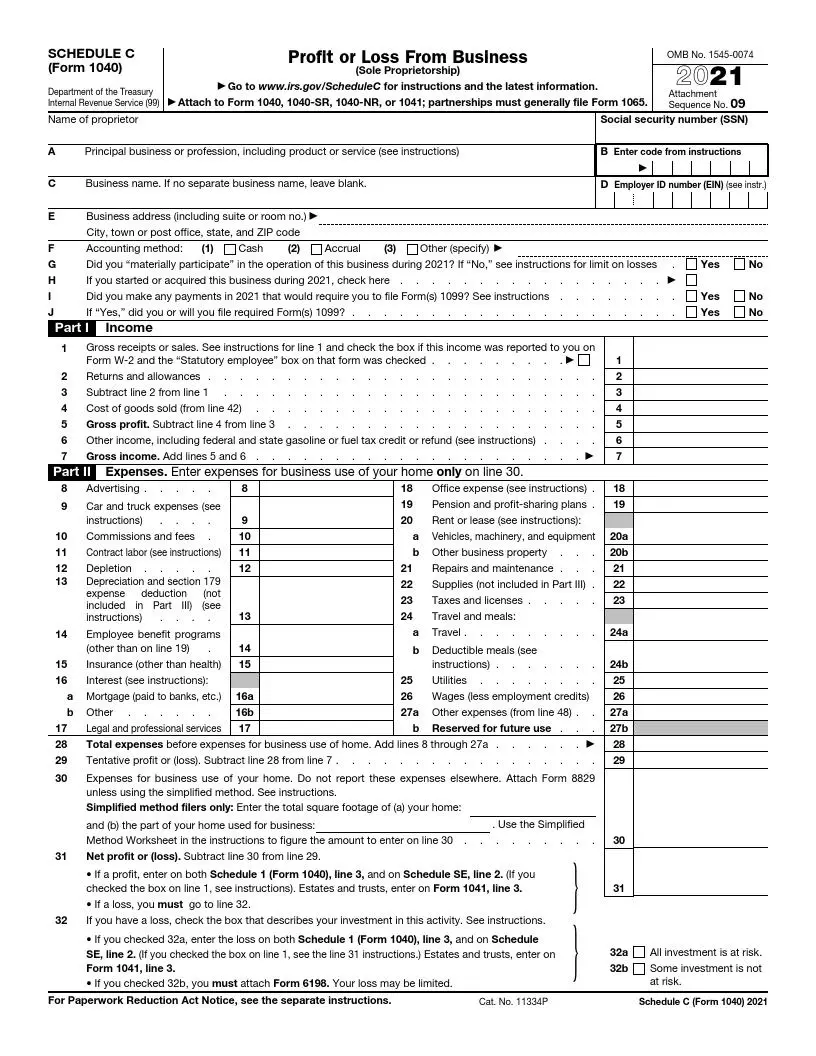

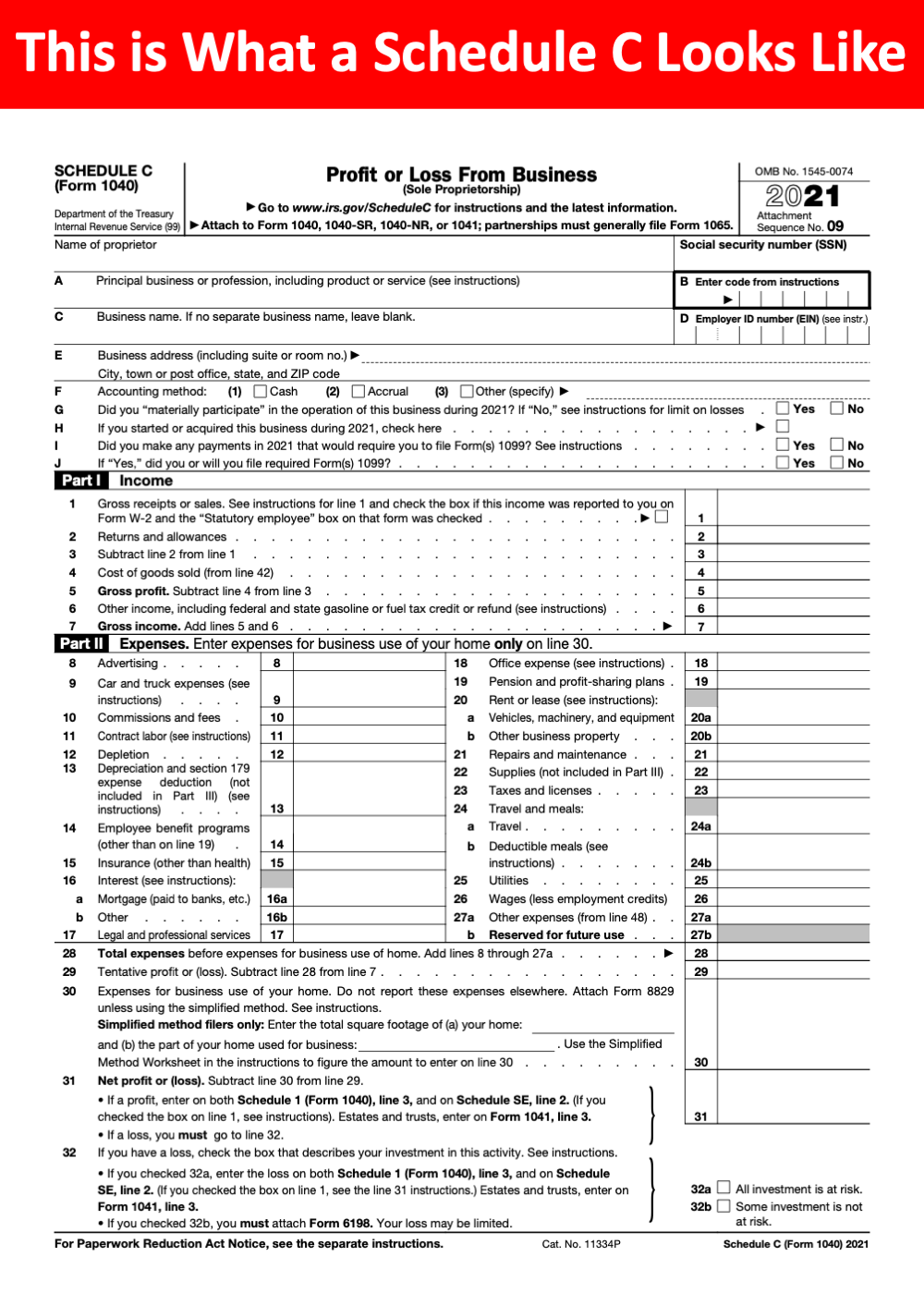

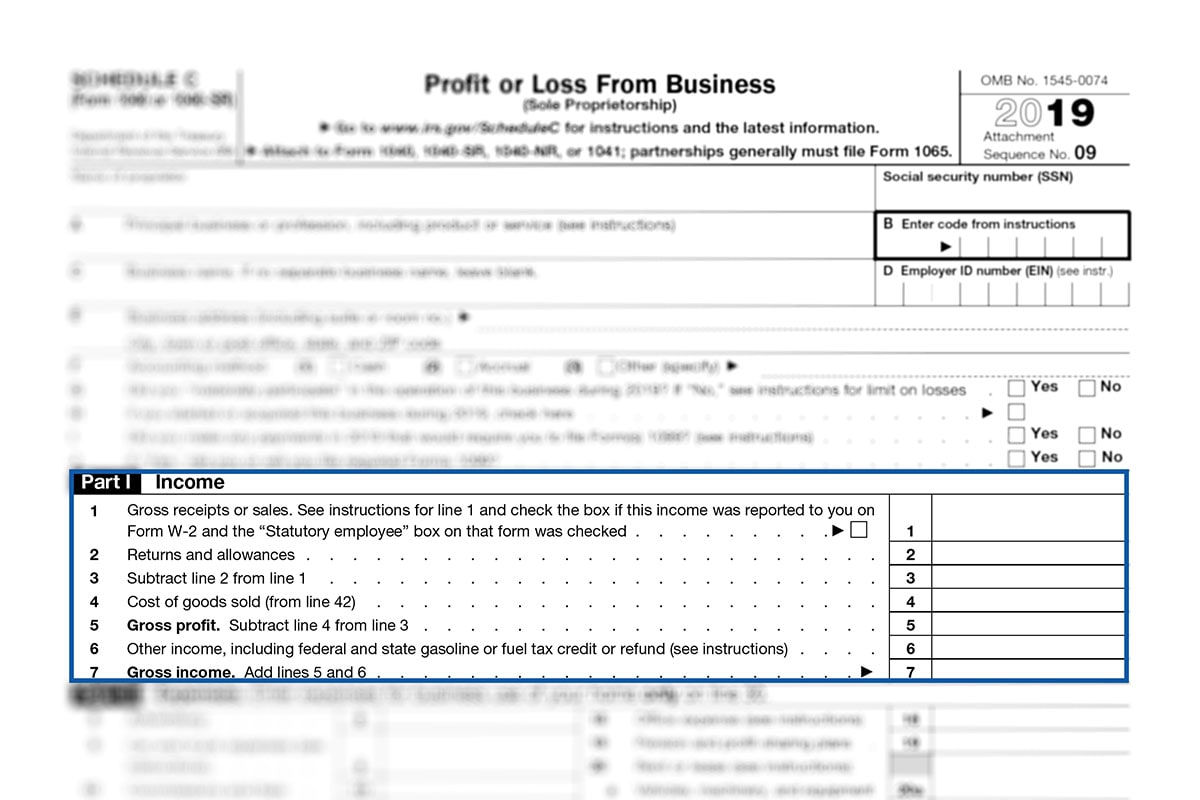

The unit owners of an LLC or stockholders of a C Corporation may be Corporations or foreign citizens. This form must be completed by a sole proprietor who operated a business during the tax year.

What Is A Schedule C Tax Form H R Block

For California purposes all unemployment compensation is excluded from income on Schedule CA 540NR line 7 Unemployment compensation column B Subtractions.

. Throughout 2019 A an LLC filing Form 1065 for calendar year 2019 owns as its only asset 50 of each of B C D and E each also an LLC filing Form 1065 for calendar year 2019. Keep in mind that you. For federal purposes the income is excluded on Schedule 1 Form 1040 line 8 Other income.

Generally for income tax purposes a single-member LLC is disregarded as an entity separate from its owner and reports its income and deductions on its owners federal. To enter this tax on Form 1040 from the Main Menu of TaxSlayer Pro select Other Taxes Menu Other Taxes Other Taxes 1 then 453Ac - Interest on Tax Due on Deferred Tax on Certain Installment Sales Gain. Page 3 Column 1.

This is reported on Form 1040 Line 62 with box c checked and 453Ac and the amount of the tax entered to the left of line 62. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e-filed or printed not including returns prepared through desktop software or FFA. Self-Employed defined as a return with a Schedule CC-EZ tax form.

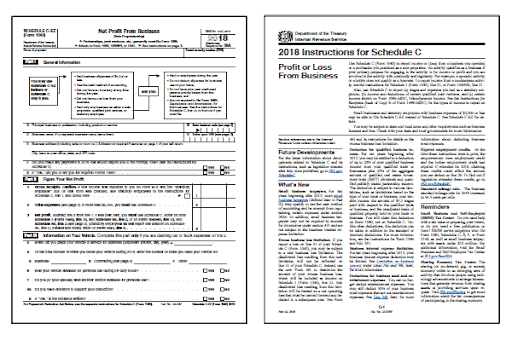

In 2018 the last year reported more than 27 million small business owners filed their tax returns using Schedule C. Online competitor data is extrapolated from press releases and SEC filings. Its used to report profit or loss and to include this information in the owners personal tax returns for the year.

Partnership C is a calendar year partnership that files and entirely completes Schedule M-3 for its 2019 tax year. What is a 1040 Schedule C. Form 568 Limited Liability Company Tax Booklet.

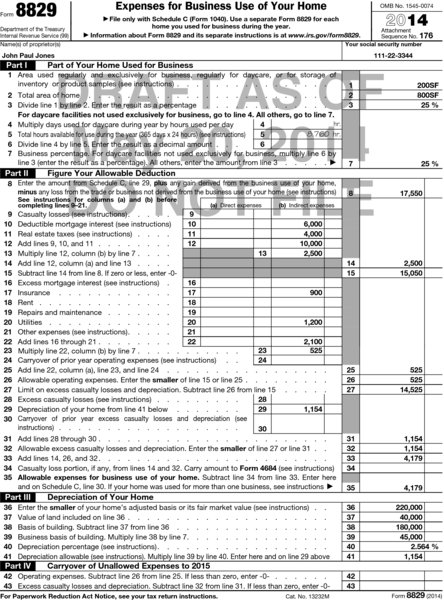

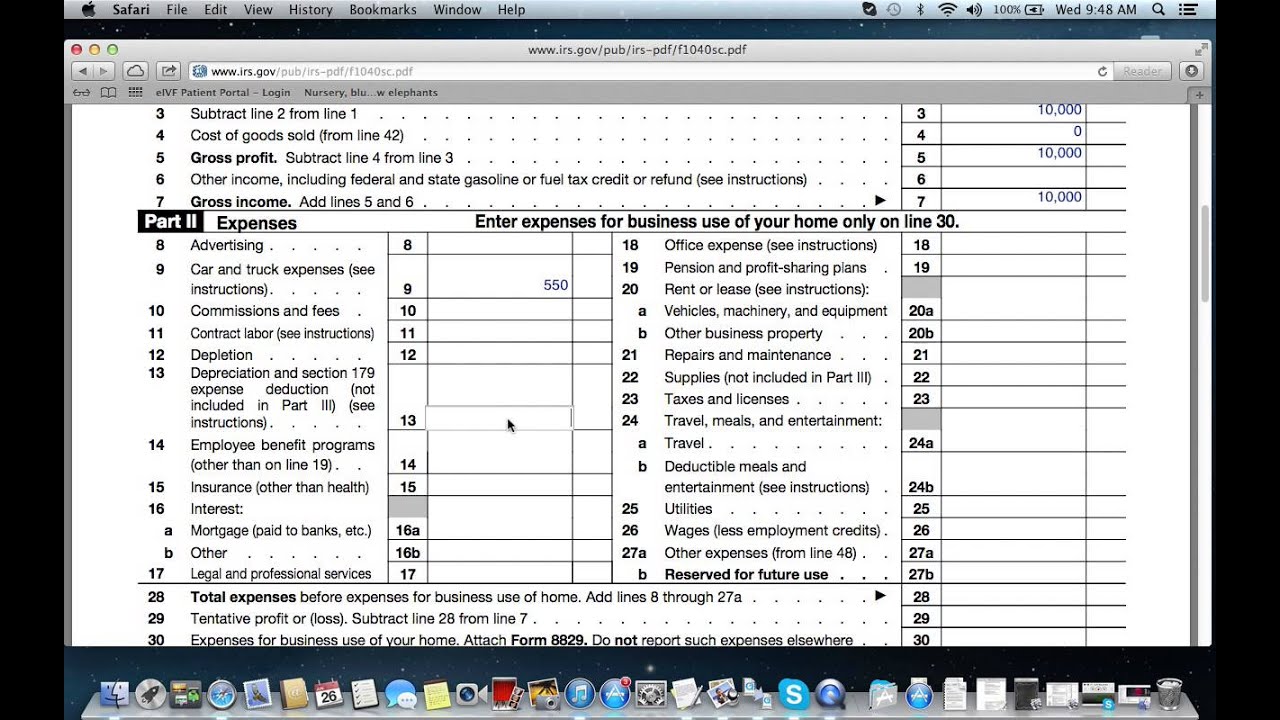

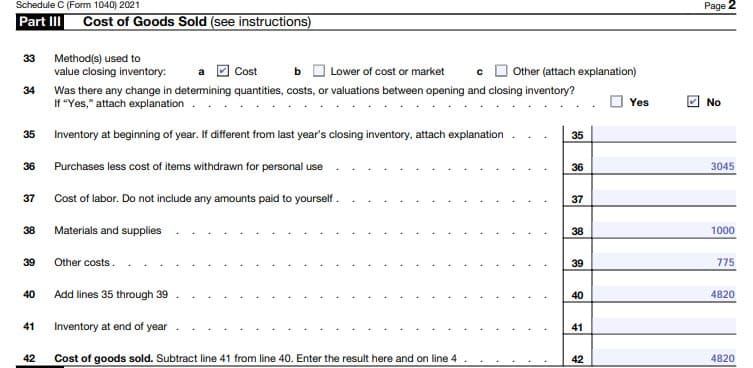

A Schedule C is a supplemental form that will be used with a Form 1040. The totals on Form 1065 are divided among the partners based on their share of the partnership as detailed in the partnership agreement or operating agreement. It is used by the United States Internal Revenue Service for tax filing and reporting purposes.

My recommendation is to file the 2020 Form 1065 as a final tax return which will reflect the liquidating distributions. For more information see Pub. I would also include a statement that the LLC taxed as a partnership is being liquidated and going forward you will be filing as a qualified joint venture in accordance with Revenue Procedure 2002-69.

Return of Partnership Income. Instead file Form 1065 US. If you and your.

C placed in service 10 depreciable fixed. LLC Tax Benefits and C Corporation Tax Benefits C Corporations ie general Corporations that dont make S Elections or LLCs that elect C Corporation tax status pay a 21 federal tax rate on all taxable income. Schedule C is an important tax form for sole proprietors and other self-employed business owners.

This form is known as a Profit or Loss from Business form. Schedule K-1 information is obtained from the partnership tax return Form 1065 which is completed and filed separately with the IRS on behalf of the business.

Self Employment Income How To File Schedule C

What Is An Irs Schedule C Form

Indie Authors Should Consider Using Schedule C Irs Tax Forms Tax Forms Irs

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

How To Fill Out Schedule C For Business Taxes Youtube

How To Fill Out Schedule C For Business Taxes Youtube

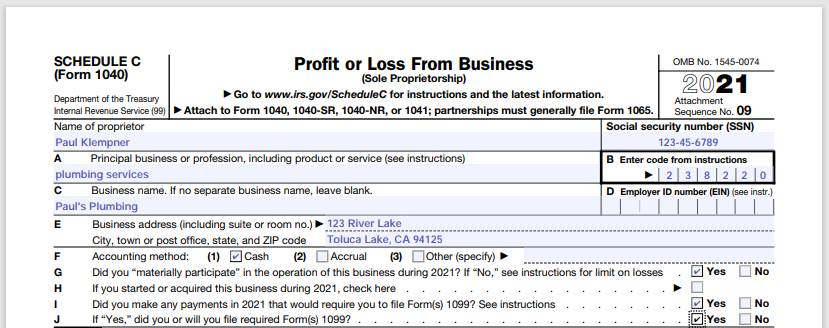

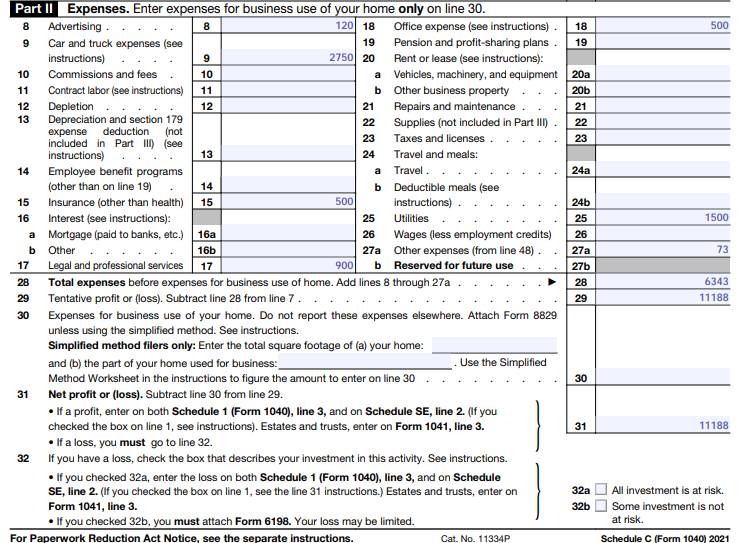

How To Fill Out Your 2021 Schedule C With Example

Tax Documents That Every Freelancer And Contractor Needs Form Pros

What Is An Irs Schedule C Form

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your 2021 Schedule C With Example

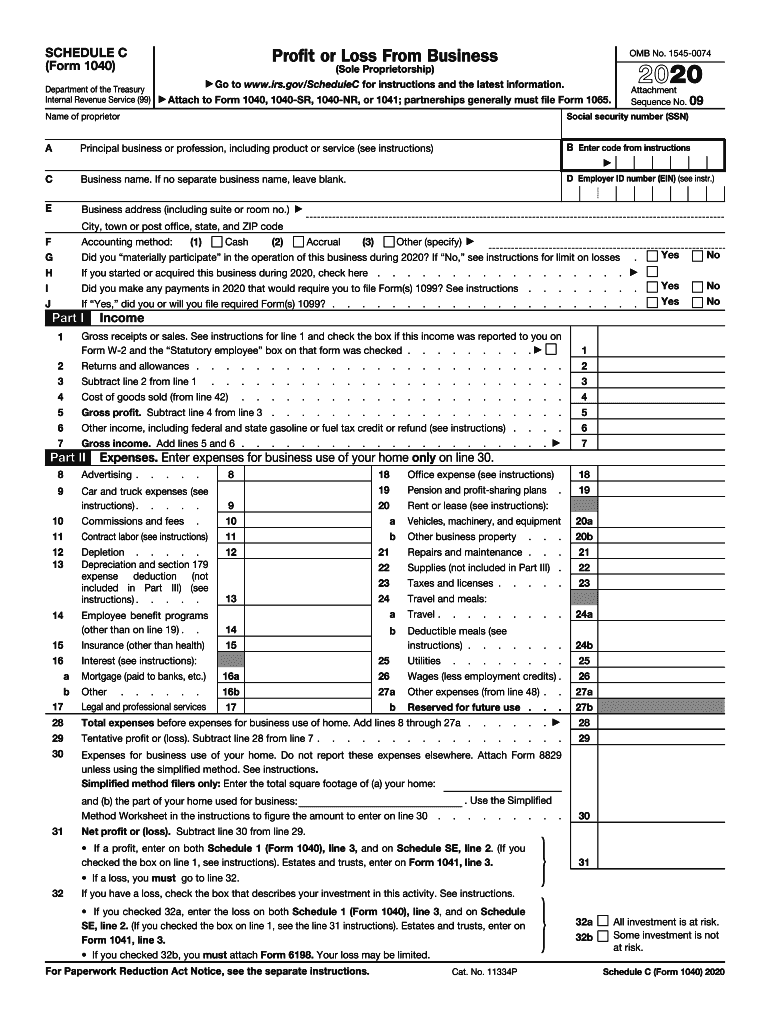

Irs 1040 Schedule C 2020 2022 Fill Out Tax Template Online

What Is A Schedule C Tax Form H R Block

Writing Off Business Expenses With Schedule C Ride Free Fearless Money

What Is Schedule C Tax Form Form 1040

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)